I believe that by 2011 (in another five years) the market share of CDMA family in the world will be less than 2%. There are many analysts out there who do predict that CDMA market (CDMA, CDMA2000, etc) will shrink but their estimates are quite generous. Currently, the market share of CDMA family in the world is around 18% but is dwindling gradually (while GSM family currently holds 81% of the market). I believe that this decreasing rate will soon pick up pace to shrink quite drastically in an exponential fashion leading to its ultimate demise.

Some of the trends in various markets in the last few months:

▪ SK Telecom and KT Freetel (in S. Korea), who collectively represent about 10 per cent of CDMA subscribers in the world are not likely to migrate to CDMA2000 1x Release A- according to Morgan Stanley report

▪ Reliance and Shyam Telecom in India, China Unicom in China and AT&T in US are switching to GSM from CDMA.

▪ VIVO (Brazil), the fourth largest CDMA carrier in the world has openly discussed the potential of migrating to the GSM roadmap- according to Morgan Stanley report

▪ According to Telstra (of Australia), ‘CDMA is on the way out and other carriers will follow Telstra's lead because we have the second biggest network in the world.’ H3G, Australia’s only other CDMA network operator, is preparing to move away from CDMA as well.

▪ Alegro PCS (of Ecuador) plans to migrate to GSM technology from the CDMA 1x platform currently in use.

▪ According to a Credit-Suisse Report, "The share of CDMA subscribers in India would drop to 7 per cent by 2010, while that of GSM would grow from 75 per cent at present to 93 per cent.''

Isn’t CDMA a better technology compared to TDMA-based-GSM?

During the time (early 1990s) when 2G networks (GSM, TDMA, CDMA) technologies were being deployed, there has been much hype about various technologies and its advantages so much so that it became difficult to understand what is artificial and what is real. While it was clear to many theorists that CDMA as a technology was efficient in spectrum usage it was hard to determine its benefits in real world. Qualcomm solved many practical problems of CDMA technology to make it a practical technology. CDMA family as championed by Qualcomm is proprietary in nature and its business is based on royalty models. There is a limit to the progress made in a proprietary technology. With fewer players, minds and resources tackling the problems, the solutions are not easy to come compared to a collaborative technology. Though the evolutions of GSM (UMTS, etc) are based on the same technology (wideband CDMA) they are collaborative in nature and not proprietary. There have instances where a better technology has lost the race to an inferior technology.

When does a better technology lose race to an inferior technology?

There is more to business than a better technology. And sometimes a better technology may lose market while an inferior technology may grab huge market share. Some of the reasons are the following:

- Timing

A better technology coming later may not find itself a place in the market because the older technology though inferior may have the market penetration which the newer technology may find difficult to replace. Example, Signal Processing based on Wavelets though proved superior could not replace the Signal Processing based on Fourier Signals for Digital TV because the technological breakthroughs required for making it possible came later (after adoption of standards).

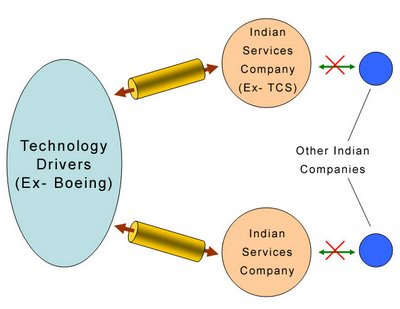

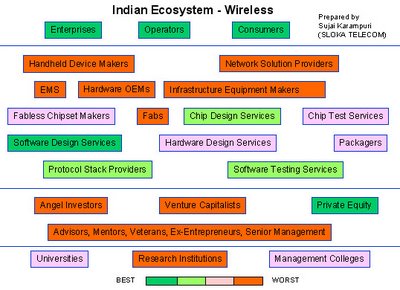

- Ecosystem

A technology has to have a good ecosystem which will keep innovating, drive the prices and costs lower, and increase the penetration into market. A good ecosystem will have many players working on the same technology- many startups innovating and decreasing the costs, big companies investing huge sums of money for development and deployment resulting in volume-based cost reductions, many customers and partners embracing this technology leading to market penetration.

- Volume

Volume once it has reached certain levels automatically drives the costs down. Once the R&D money is recovered the volume-based business usually lowers the costs making it attractive to the customers fueling market penetration. A newer technology though superior may not be able shake such volume-based businesses.

- Cost of Development and Deployment

The cost of development of a certain technology (during R&D and production) and the cost of deployment (cost in making it available to the customer) are important components in keeping a technology alive. Two competing technologies with different cost of developments will have different growth paths. A technology which offers superior user experience and features but with higher costs may find itself unattractive compared to a competing technology with inferior features but with affordable pricing.

Every technology faces competition- some survive and some die out. If a technology keeps improving itself, updating itself and is flexible in its business model then there are greater chances for its survival. However, a new technology though lacking all the above may still replace the older one if it introduces a completely new way of life which wasn’t available before (like the wheel or air travel). But be assured that it will face competition from a newer technology later in time and will be tested on the above parameters once again.

CDMA family is going to die out

Qualcomm’s CDMA is going to die out because it lacks in (2) Ecosystem and (4) Cost of Development. It hasn’t been able to develop the ecosystem because of its proprietary nature. Its business model on getting royalties on various forms of its technology hasn’t been able to spur many new companies and startups that could have benefited in promoting the technology to create this ecosystem. Innovations could not happen at the same pace (that of GSM family) because it was closed to new companies. Research and Development efforts at various big companies were bogged down by patent infringements cases and other royalty obligations. Qualcomm went into war with many companies including its partners and customers.

The cost of development is also high because of huge barriers (to entry) making it less attractive for entrants including newer and smaller companies. The cost of development, owing to less innovations, lack of ecosystem, and royalties, is higher compared to developing GSM family equipment- both infrastructure and handsets.

I don’t think the ‘royalty issue’ raised by Reliance (India) attributing it to higher cost of handsets is the only issue in making this strategic decision (of slowly moving to GSM family). It’s not the handsets alone but the complete infrastructure (and upgrades) which is expensive in CDMA family. Qualcomm gave lot of concessions to operators during deployment phases but expected to recover them through amortization that included sharing of profits from the operators. Once the operators started to feel the burden they became uneasy.

On the other hand, GSM family benefited from incremental innovations and marginal differences in each stage of development of the products resulting in a compounded effect of lowering the costs at all levels. The cost of developing infrastructure equipment and handsets is reducing drastically in the GSM family. Over a period of time, this difference in development costs, which did not seem obvious because of many incentives during development and deployment, became apparent as the operator started feeling the pain. Moreover, the user experience was lacking in CDMA family compared to GSM family. The operators who saw these trends started looking for alternatives (in this case, opting for GSM family). However, these operators may not switch right away because their skin is already in the game. The bigger operators can make the switch sooner and faster though incurring some losses, but the smaller ones will find it difficult to switch right away. The opportune time for this switch is when an operator has to overhaul its network (like moving from 2G to 3G, etc).

What is the future of Qualcomm?

I think that Qualcomm will transform itself into a 3G/WiMAX company contributing to advancement of these technologies producing chipsets for handsets, etc. It is already making strides in HSPA technologies and its recent acquisition of Flarion will also give it an added advantage in contributing towards OFDM based technologies. In my opinion, Qualcomm should just join others in promoting WiMAX instead of trying to create another market backing Flarion-based proprietary OFDM technology. There is another hurdle that Qualcomm has to cross to be able to make an impact on WiMAX (if it indeed joins WiMAX). It has to put efforts towards an effective and successful integration of Flarion, its people and technology, into the existing organization. Many great companies have floundered with acquisitions, and a cult like following that Qualcomm promotes may find it extra difficult in integrating Flarion into its fold to make any effective contribution.

Notes:

▪ CDMA family includes CDMA, CDMAOne, CDMA2000 and other evolutions like EVDO, 1xRTT, 3xRTT, etc, and are based on Qualcomm’s CDMA technology. This is currently deployed by operators like Verizon and Sprint in US and Reliance and Tata Indicom in India.

▪ GSM family includes GSM, GPRS, EDGE, UMTS, HSDPA/HSUPA and is deployed by operators like Cingular and T-Mobile in US and Airtel and Hutch in India.

Some Links: [1], [2], [3]