My previous article on ‘Why Infosys cannot become a product-making company’ was just a small part of the bigger problem-statement

Why I stress on such an ecosystem to be here in

Take examples of companies like Intel, Cisco, Siemens, Boeing,

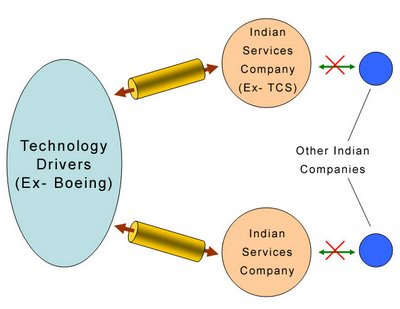

Right now, some of these technology and product making companies use the services of many Indian companies- dealing with each of them independently to get the work done. The following picture illustrates this. Each of these Indian companies completes the project to enable this technology driver to make a product or develop technology. What an Indian company ends up is getting revenue for this project and also the experience of technology. Unless this experience is used to promote the same technology or product here in

Who is driving the technology in this picture? Who knows where and what will happen in three years from now. How many of the senior management at TCS and Satyam will be able to say with confidence what they will be working on and what they will be delivering three years from now? If indeed they know this, did they make the decisions or was the decision handed over to them from their client?

Thomas L. Friedman in his famous book titled The World is Flat has described the changes that are taking place in our world owing to fast communication and travel, bringing together diverse people of different countries (like

However, Friedman looks at it from an American (and West) perspective. His motivations are driven by what is good for

Yes, the world is flat- it is flat for the western world, which drives the technology and the markets. For the followers and servicing organs like

While it is extremely important for Americans and Western economic powers to wake up to this new flat-world order, recognize it and understand it so as to exploit and benefit from it, it is easy for Indians and Chinese to get misled by this interpretation into believing that the equations that hold good for an technology driver are also valid for him. That is not the case. While servicing these technology drivers in what is seen by them as a flat-world he is benefiting from it in a very narrow scheme of things. By not reaching the same level of being in the driving position he is losing out on the bigger scheme of things. This new flat-world order continues to keep the western powers at the helm using some select few developing countries as supporting and ancillary partners. It does not however bestow upon these select few developing countries the role of a leader. An Indian and Chinese should not get carried away by the interpretation of this new flat-world order into believing that he is an equal partner. He should not quickly conclude that he has an equal role to play in his respective segment (services- software or manufacturing). An inherent hierarchy of control still exists.

Many Indians, living in

Take one consequence of this flat-world- Outsourcing of BPO has positive and negative fallout. While it is enabling many a youth to make a quick buck who otherwise would never been able to dream of making such money, it is also creating a youth which is confused, having the lowest sense of professional ethics, and seems to bring in a social structure which the Indian family is not used to. The question remains- is this a sustainable business? Outsourcing is a good stepping stone to something more sustainable, tenable and long-lasting. But what is that? Are we moving in that direction?

The world is flat, but the world is flatter for some than others.

I do not agree that the World is Flat for everyone. I think it is flat for those countries and companies who are in the driving seat. For all those countries and companies who are followers, the world is still round. Having multiple locations (in different countries) for a services company like Infosys, Wipro or TCS is not going to make this world flat for them. If indeed they believe this, they are fooling themselves. Putting offshore units in

R&D organizations should be made of closely knit groups. All my experiences working on multiple R&D locations (in different countries) were major disasters. The projects kept on getting delayed running into years and many of them seriously failed. Only those locations which kept their entire R&D team for a technology or product closely knit were able to deliver with success.

A software services company like TCS might be bagging many contracts from different companies in various domains. How many other companies in

Outsourcing across continents and countries is a gap filling exercise. New technology, like internet, has given us tools to try out different experiments and that’s what we are doing. The problems associated with long-distance and different locations will soon dominate and this whole exercise will be reexamined.

Champions of Indian services industry may look at examples like IBM, Accenture, EDS, etc, as role models. How many companies can you create out of

By employing 1 million engineers we may be able to take it to $40B. Using the present model of services, by employing 5 million engineers we may be able to take it to $200B in the next ten (or twenty) years. Now, Compare with this. Google with 6,000 employees is a $6B company. Nokia with 40,000 employees is a $40B company. With 1 million engineers we should be aiming at making $1 trillion. That’s when this country will be a developed nation.

Links:

Shashi Tharoor: Imperfections in Friedman's Flat World

Infosys: Think Flat Blog